Are you a business owner looking to expand your operations? Or an investor searching for promising investment opportunities? The Greek government has recently amended its Strategic Investments regulatory framework to make it easier for investors like you to set up your business in Greece.

Investing in Greece has become even more attractive with the introduction of Law 4864/2021. This law in combination of the following Minesterial Decrees provides a framework for strategic investments in the country and offers a range of incentives to encourage investment.

Legal Framework of Strategic Investments:

1. Law 4864/2021 (GG A΄ 237), as amended and currently in force

2. Ministerial Decree no. 78609/4.8.2022 (GG Β’ 4263/10/8/2022) “Determination of the selection process of auditors and the appointment of an expert, their obligations, the audit objects, the procedure, the terms and the conditions for the control of the implementation of investments that have been characterized as strategic investments”

3. Ministerial Decree no. 65429/27.6.2022 (GG Β’ 3450) “Determination of the amount, by type of aid, for the investment projects classified as Strategic Investments, in accordance with the provisions of Laws 4608/2019 and 4864/2021”

4. Ministerial Decree no. 61746/16.6.2022 (GG Β’ 3188) “Determination of the terms, conditions and procedures for the implementation, modification, audit and completion of investments characterized as strategic in accordance with Laws 4864/2021 and 4608/2019, payment of the aid and compliance with the obligations of the investment entities”

5. Ministerial Decree no. 62120/16.6.2022 (GG Β’ 3142) «Determination of the procedure of characterization of Emblematic Investments of Exceptional Importance of Law 4864/2021, the procedures of monitoring and audit of their implementation and of the payment of the aid”

6. Ministerial Decree no. 62147/16.6.2022 (GG YODD 507) “Establishment of a three-member committee for the characterization of investment projects as “Emblematic Investments of Exceptional Importance” in accordance with the provisions of Law 4864/2021”

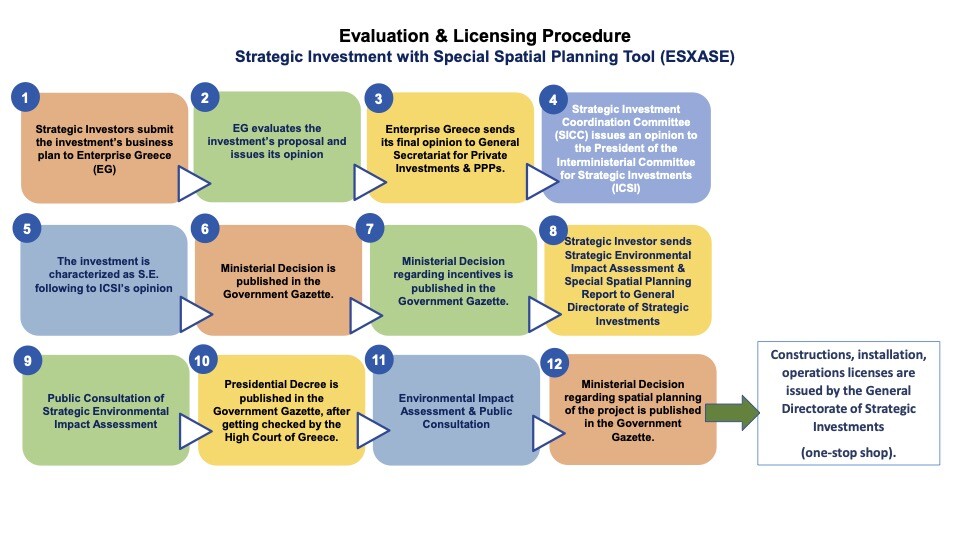

Step Plan

Entities interested in investing in Greece can submit their investment plan to the Hellenic Investment and Foreign Trade Company S.A. (Enterprise Greece: https://www.enterprisegreece.gov.gr/en/) for evaluation. Within 45 calendar days, Enterprise Greece will assess the completeness of the file and its feasibility for inclusion in the Strategic Investments framework.

Once the file is deemed complete and feasible, it will be forwarded to the General Secretariat for Private Investments and Public-Private Partnerships (GSPI & PPPs) of the Ministry of Development and Investments.

The GSPI & PPPs will then submit the file to the Coordinating Committee for Strategic Investments (S.E.S.E.), and the relevant meeting of the Interministerial Committee for Strategic Investments (D.E.S.E.) will be prepared.

Within 30 calendar days of receiving the investment file, D.E.S.E. will decide whether to classify the investment proposal as a strategic investment and determine its inclusion in one of the categories of Article 2, implementation cost, jobs created, and incentives granted. The decision of D.E.S.E. will be published in the Government Gazette.

The General Directorate of Strategic Investments, operating under the GSPI & PPPs, is responsible for the implementation and monitoring of strategic investments in Greece. Its main objective is to implement the national investment policy strategy for attracting strategic investments and monitor the progress of investment projects. The General Directorate offers a one-stop-shop for investors, accelerating procedures and providing centralized licensing.

Investing in Greece through the Strategic Investments framework offers several benefits, including access to incentives specified in accordance with Greek and EU law, facilitation and coordination for the granting of permits, and the issuance of Special Spatial Development Plans for Strategic Investments (ESHASE).

With Law 4864/2021, Greece is positioning itself as an attractive destination for strategic investments, and investors are encouraged to explore the opportunities available in the country.

What is the Strategic Investments Law?

The Strategic Investments Law 4608/2019 aims to attract large-scale investments with qualitative characteristics across all strategic sectors of the economy, with legal certainty, fast-track procedures, and efficiency for investors, public authorities, and the economy as a whole. The law provides various incentives and fast-track procedures for investors to streamline the process of starting a business in Greece.

What are the key provisions of the new regulatory framework?

Strategic Investments now refer to more sectors of the economy, including manufacturing and research and development (R&D).

Enhanced incentives are provided, especially for manufacturing and R&D.

The law provides the possibility to use real estate owned by the Greek State or Public Sector (excluding real estate owned by Hellenic Republic Asset Development Fund https://hradf.com/en/home/ or by Hellenic Corporation of Assets and Participations https://www.hcap.gr/en/) for private investors to implement Strategic Investments.

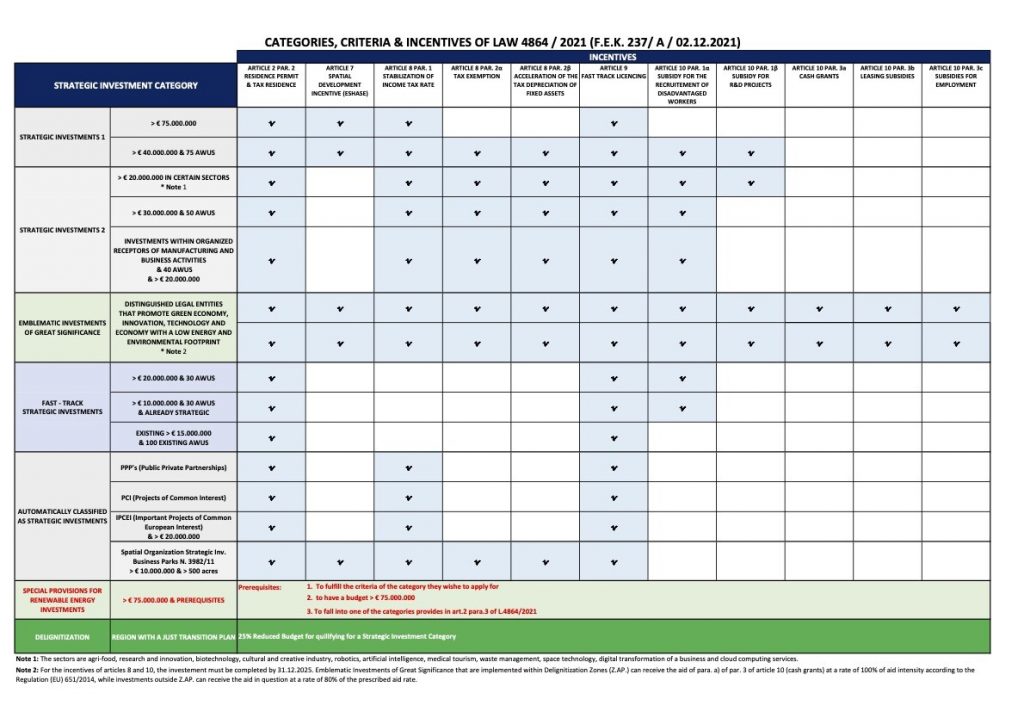

Strategic Investments are categorized according to provided incentives.

The criteria for the inclusion and the evaluation of the investment proposals are now specified.

The law introduces an organized electronic public consultation.

The Fast Track Procedure has been accelerated.

The law introduces the mandatory signing of a Cooperation Memorandum between the Public Authority and the Investor which includes a binding timetable for the licensing and the implementation of the investment.

The law provides for the possibility to submit for Arbitration all the disputes arising from the interpretation and implementation of the Cooperation Memorandum.

The law introduces an auditing process for the implementation progress of the investment as well as a procedure for imposing penalties in case of the investor’s inaction.

What are the investment incentives provided?

The investment incentives provided by the new regulatory framework of Strategic Investments are the following:

Tax incentives

The stabilization of the tax rate incentive is provided for all the Strategic Investments categories.

The law provides for the possibility for a tax exemption, i.e. the exemption from income tax on pre-tax profits arising, according to the tax legislation, from the total business activities of the entity, after the deduction of the corporate tax which relates to the distributed or undertaken profits.

The law provides for the possibility for the acceleration of the tax depreciations of the assets which are included in the approved investment plan, with a 100% increase of the relevant rates.

The depreciation of machinery and equipment is deducted from the gross revenue at the time of their realization, increased by a percentage of 30%.

Fast Track Incentives

All licenses, approvals or opinions required for the establishment or the operation of a Strategic Investment are issued within a deadline of 45 calendar days starting from the submission date of the relevant dossier by the Investor. The licensing authority examines the formal and substantial completeness of the dossier and, within 15 calendar days and once only, may request for additional information. In such a case, the deadline is suspended and commences again from the submission of the additional information. In any case, the aforementioned 45 day deadline cannot be extended.

If the above deadline elapses, the law provides for the possibility for the Minister of Economy and Development to issue or reject the relevant license on justified grounds.

Incentives for increasing expenditures

The law provides for grants in order to cover part of the eligible expenses. In particular:

i. Grant for the recruitment of disadvantaged and disabled employees, which, combined with any other State aid, cannot exceed EUR 5 000 000 per investment plan.

ii. Grant for R&D projects, which, combined with any other State aid, cannot exceed (a) EUR 20 million per investment plan for projects mainly related to industrial research; (b) EUR 15 million per investment plan for projects mainly related to experimental development, and (c) EUR 7,5 million per investment plan for feasibility studies and research activities preparation

Residence permit and executives’ tax treatment

Visa D and a ten-year residence permit, renewable for ten more years, are permitted to be granted to a maximum of ten executives of the investment regarding all Strategic Investments categories. The executives of the Strategic Investments may be accompanied by their family members to whom a residence permit for family reunification is also granted.

Executives, employed in the Strategic Investment and non tax residents in Greece, are exempt from the taxation of their global income in Greece, with respect that they are deemed to retain their tax residence abroad and are subject to Greek tax only for their income derived in Greece in a certain tax year and during the period the employment relationship lasts. A similar tax treatment also applies for their dependent children as well as for their spouses or the other party of a cohabitation agreement, under the condition that the spouse or the other party has no working activity in Greece.

At Amoiridis Law Services® we are dedicated at assisting our well-respected clients successfully complete any of their investment projects in Greece. Thanks to our longstanding experience, we are able to provide a full package of consultancy services to our almost exclusively international clientele, customized to their specific needs.

As a result, we have represented clients from all around the globe regarding their projects in Greece. Our network of associate experts, composed by both in-house and external solicitors, notaries, accountants, tax experts, currency exchange experts, realtors etc., enables us to provide an all-in-one package of consultancy services, guiding you through the ways to properly protect your investments.

For any further information and clarifications please do not hesitate to contact our qualified legal team, ready to provide you with further personalized information tailored to your needs and your profile.

You can email us: or call/text us directly at: +306908351705 (WhatsApp/Viber)

Athens, March 2023